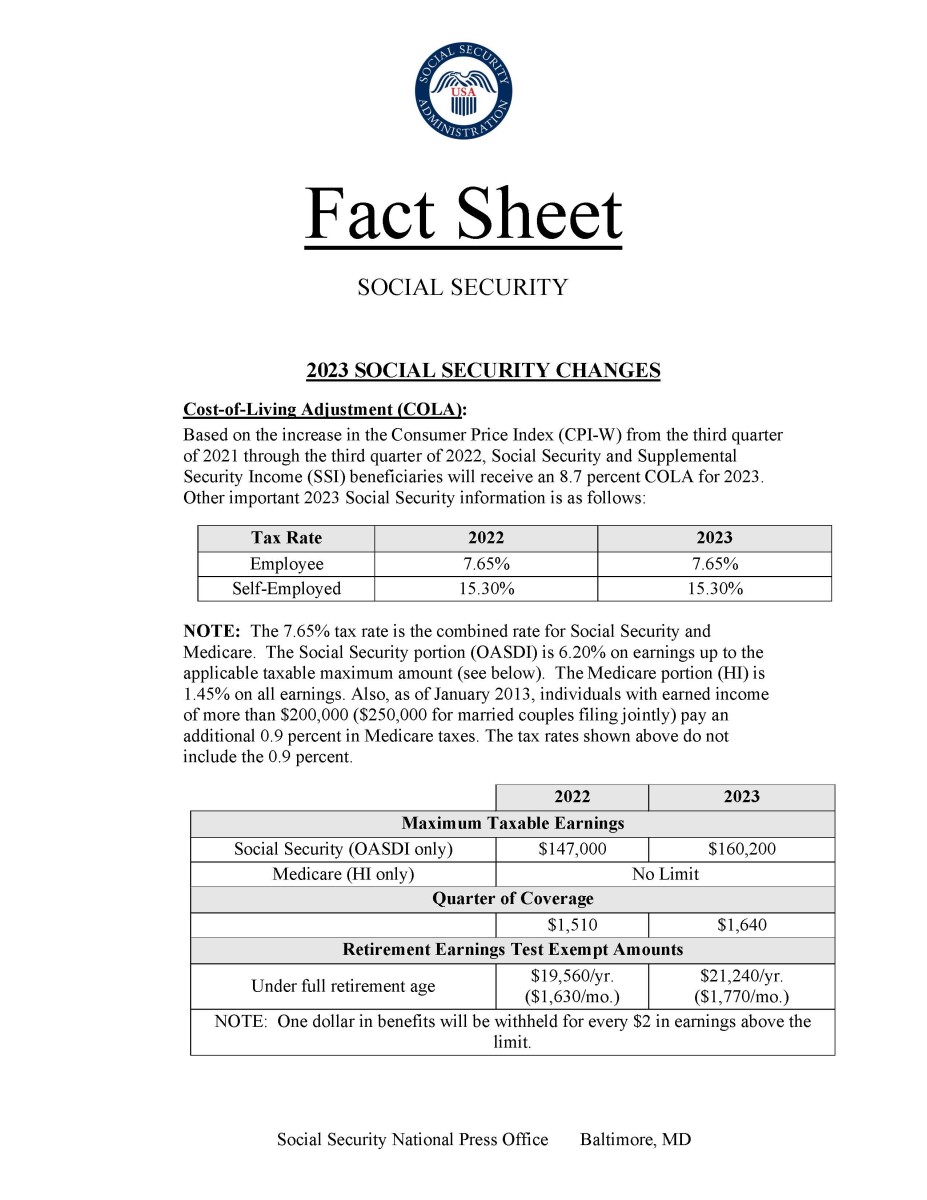

2025 Ssa Maximum Earnings. In 2025, the maximum earnings subject to social security payroll taxes will rise to $168,600 from $160,200. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600.

Likewise, the maximum amount of earnings subject to social security tax will increase to $168,600. The penalty is lower if you have a certain number of earnings years that meet the definition of substantial.

If you are working, there is a limit on the amount of your earnings that is taxed by social security.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png)

If you turn 62 in 2025 (ely 2025) and you have 20 years of substantial earnings, wep reduces your monthly benefit by $587.

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, For example, if you retire at full retirement age in 2025, your maximum benefit would be $3,822. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600.

Annual Earnings Limit For 2025 Abbey, Be under full retirement age for all of 2025, you are considered retired in any month that your earnings are $1,860 or less. The maximum amount of social security tax an employee will have withheld from their paycheck in 2025 will be $10,453.20 ($168,600 x 6.2%).

2025 Social Security Disability Earnings Limit Roxy Wendye, 27 rows for people attaining nra after 2025, the annual exempt amount in 2025 is. If you are working, there is a limit on the amount of your earnings that is taxed by social security.

Sign Up For Ssi Retirement Learn about earning limits if you plan to, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. If you turn 62 in 2025 (ely 2025) and you have 20 years of substantial earnings, wep reduces your monthly benefit by $587.

Social Security Announces 8.7 Benefit Increase for 2025 Retirement, (refer to the chart below.) your full retirement. We raise this amount yearly to keep pace with increases in average wages.

Calendar 2025 Full Month Title Banner Vector, Calendar 2025, 2025, Starting with the month you reach full retirement age, you. In 2025, the maximum wep penalty is $558;

Buy 2025 Vertical 11×17 2025 Wall Runs Until June 2025 Easy, (refer to the chart below.) your full retirement. In 2025, the maximum earnings subject to social security payroll taxes will rise to $168,600 from $160,200.

Calendar 2025 Vector Images Clipart Download, Calendar, 2025 Calendar, For example, the maximum amount of earnings. In 2025, the maximum earnings subject to social security payroll taxes will rise to $168,600 from $160,200.

2025 NBPPC 2025 National Bridge Preservation Partnership Conference, The penalty is lower if you have a certain number of earnings years that meet the definition of substantial. If you are working, there is a limit on the amount of your earnings that is taxed by social security.

COSMETISTA EXPO NORTH & WEST AFRICA 2025, In 2025, the maximum wep penalty is $558; In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600.